Market Update March 2023

In this edition of The Smith Report, we will be talking about 3 things to help you navigate the marketplace:

- Rates

- Inventory

- Should I buy a home right now?

As always, it is a pleasure to be able to serve you and your family. We take our job seriously in doing our best to bring value to your real estate journey. I would like to remind everyone that there is no good news, and there is no bad news. News is just news, in a similar fashion where facts are facts. Anything after that is a matter of perception and a state of mind.

Interest Rates

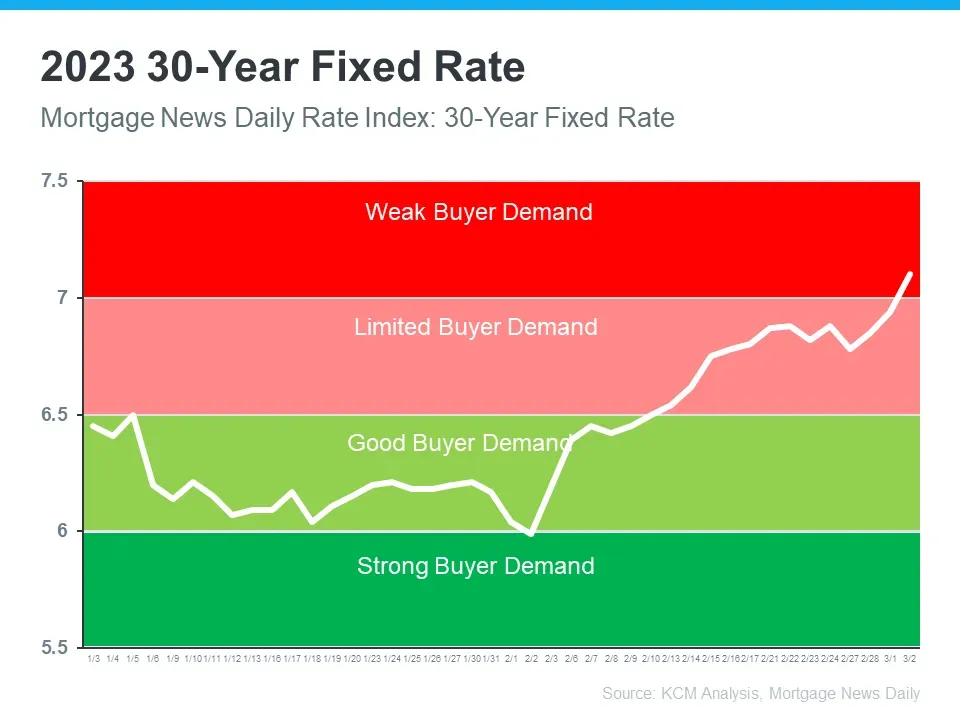

We started 2023 with good buyer demand. In the first part of February, we saw rates drop into the 5% range. With uncertain economic news relating to inflation, interest rates began to climb again. This caused some panic and uncertainty in the marketplace resulting in limited to weak buyer demand as you can see in the graph below.

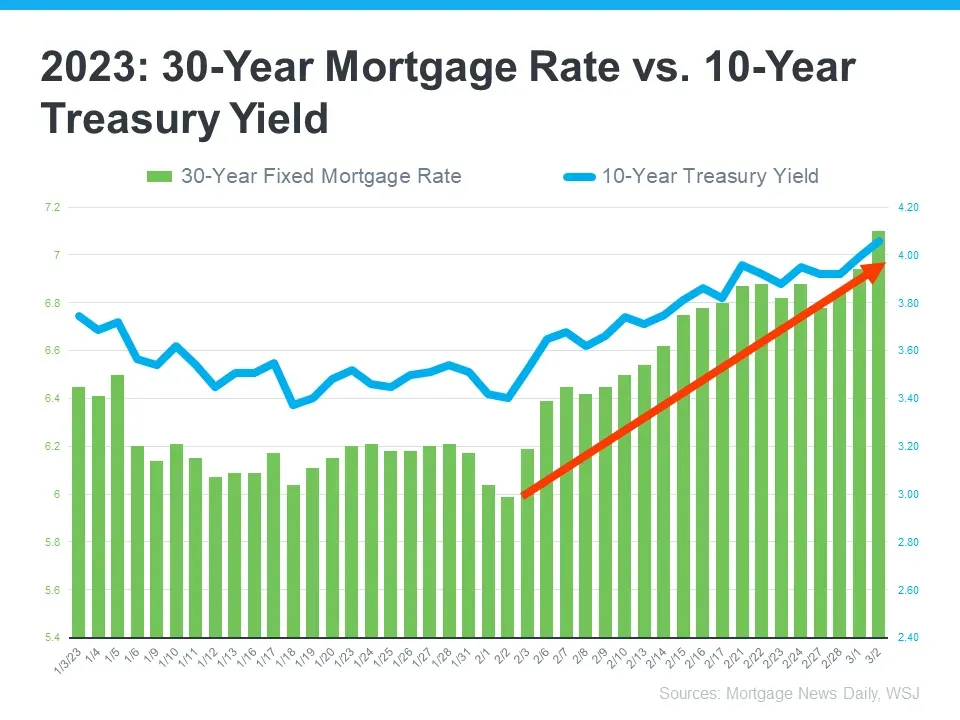

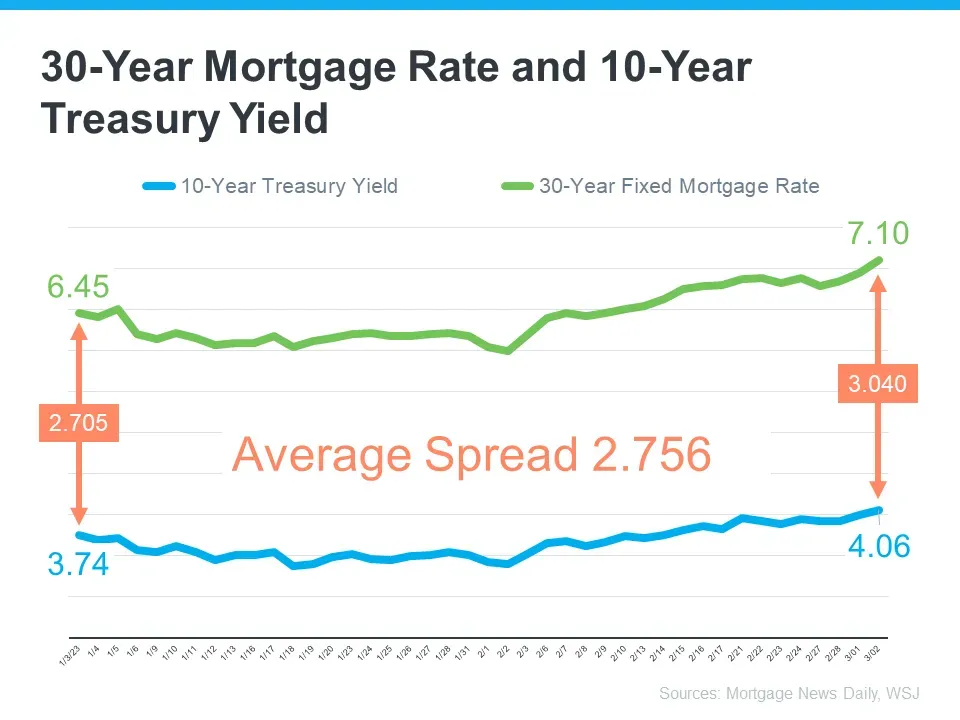

A large influencer of mortgage rates is the 10-year treasury yield. As you can notice in the graph. When the 10-year treasury yield moves, interest rates tend to follow it. Through February as the 10-year treasury yield moved up interest rates followed. The reason rates shot straight up to catch up with the 10-year treasury yield is best stated by Sam Khater, Chief Economist, Freddie Mac.

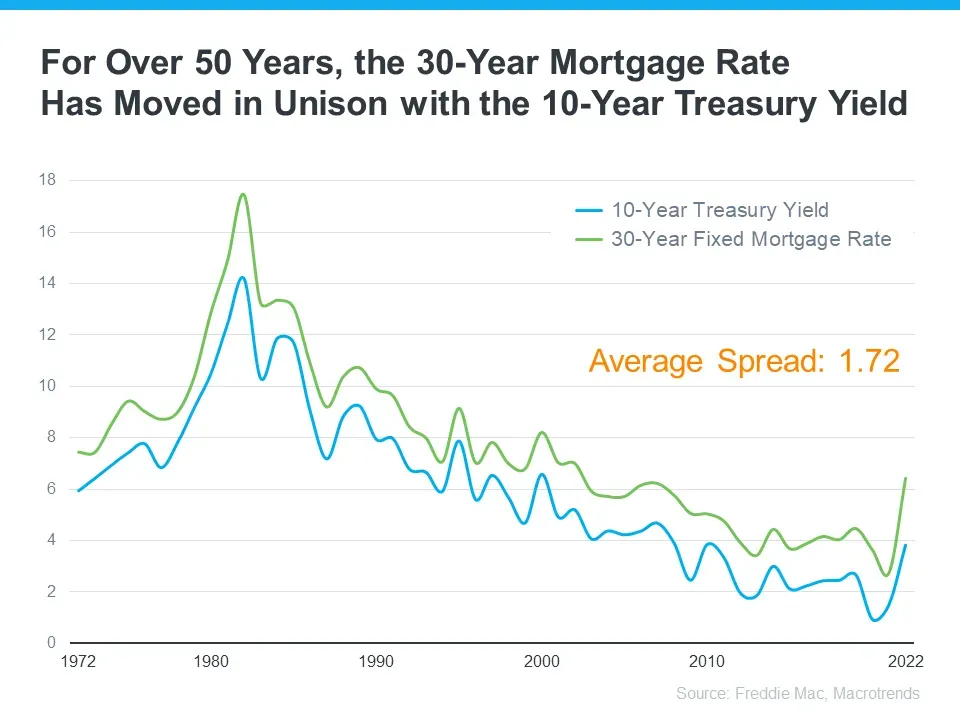

Over the last 50 years, the 30-year mortgage rate moves in unison with the 10-year treasury yield. Throughout this symbiotic relationship, it has maintained an average spread of 1.72%. This year we learned that the spread between the 30-year mortgage rate and 10-year treasury yield has widened to an average spread of 2.756%. This 1% increase in the spread is a measurement of fear and volatility.

What does this mean to us as buyers?

Adjustable rate mortgages and buy-down programs are more important than ever. Right now we have a couple of rare programs available through our partner lender.

- We can redirect your down payment funds towards buying down your rate and it still counts as a down payment.

- We can get you “yesterday's†low rates in today’s market.

- We have a unique opportunity to assist you in getting as close as you possibly can to a 4.5% rate with our partner lenders’ various exclusive programs, tools, and resources.

Inventory

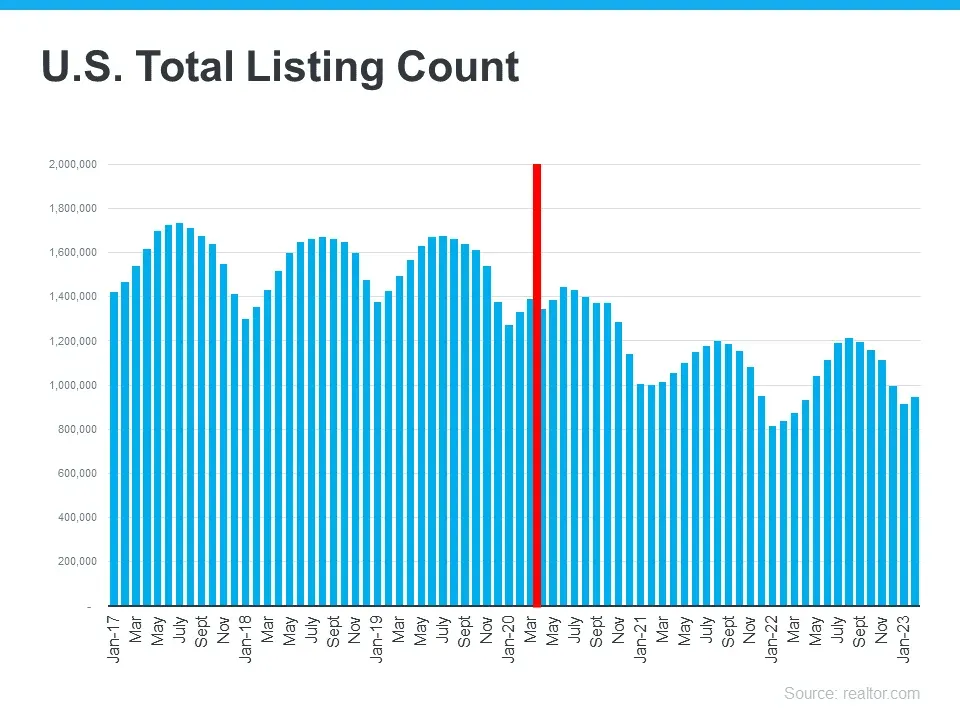

One of the biggest challenges we are facing in the marketplace is inventory. Since COVID inventory has been decreasing. In the bar graph below you will notice healthy inventory levels from January 2017 through January 2020. COVID began in the Spring of 2020 and you can see inventory levels drop through to January 2023.

Why?

The meaning of Home changed. People started working from home, kids were being homeschooled, lunch was at home, gym, yoga, and working out was done at home… etc., etc. Everything revolved around a home and interest rates hit 2.75%. Different needs in a home surfaced during COVID. With this low rate, available buyers began jumping into the market to not miss this opportunity. Finding a home that could fill these new needs, whether the home already had what people were looking for already or it had the room to build more add-ons, is what started to deplete inventory and fueled the market we have recently seen over the last few years.

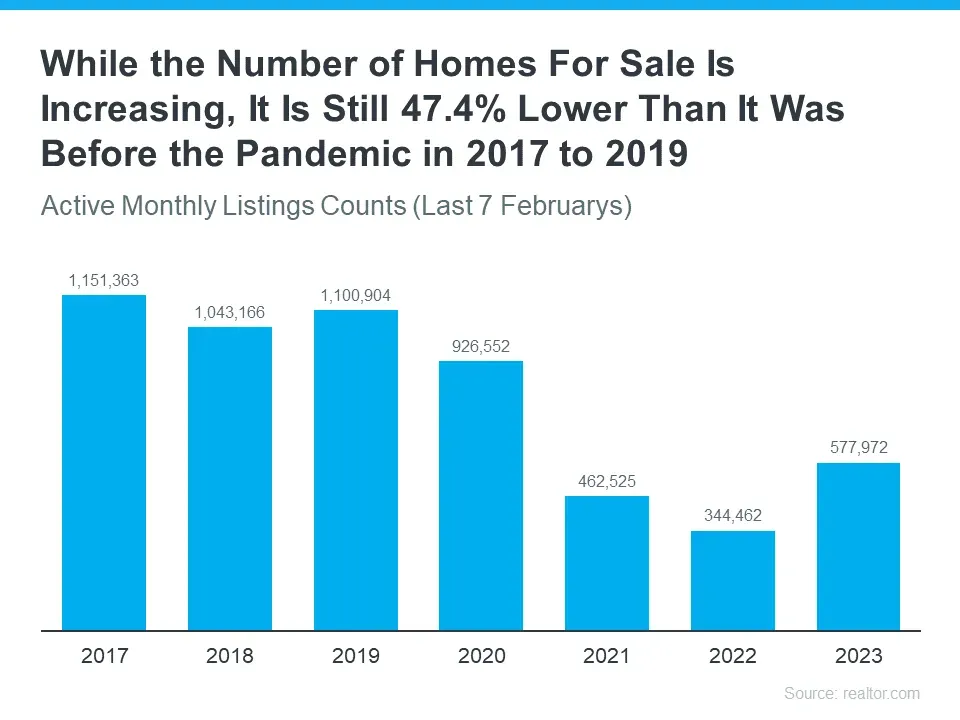

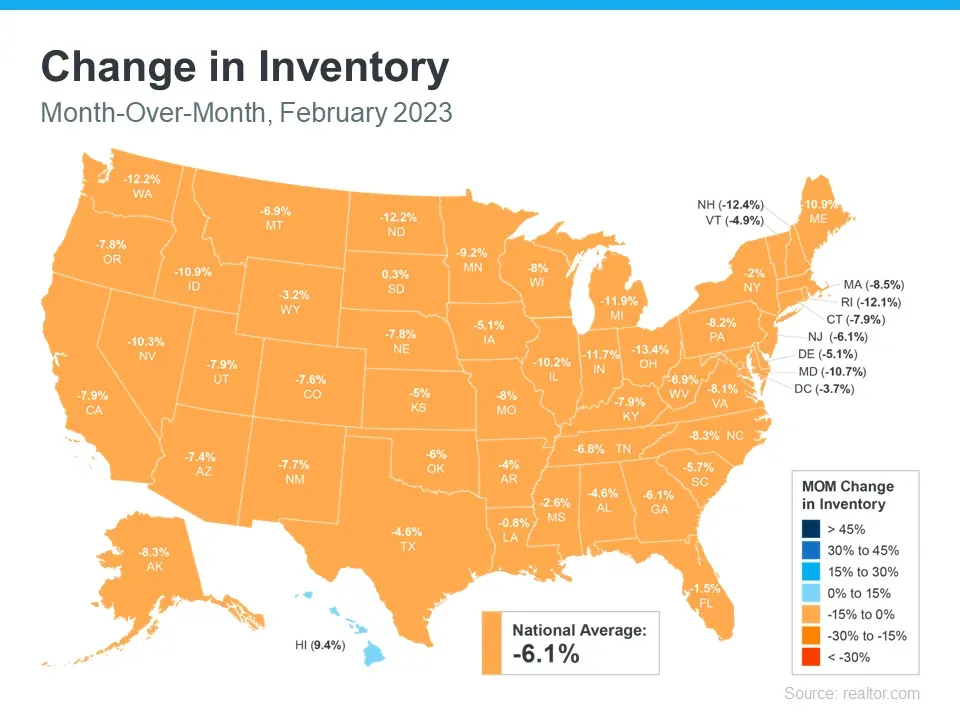

A closer look at inventory over the last 7 years shows a clearer comparison between a normal healthy market between 2017 to 2019 and an unhealthy market between 2021 to 2023. The bar graph does a great job of giving a visual reflecting low inventory in the marketplace. As we are shown in the graph below we are continuing to see less and less inventory. The lack of inventory keeps upward pressure on prices. This is the reason things haven’t gotten out of control like in 2008.

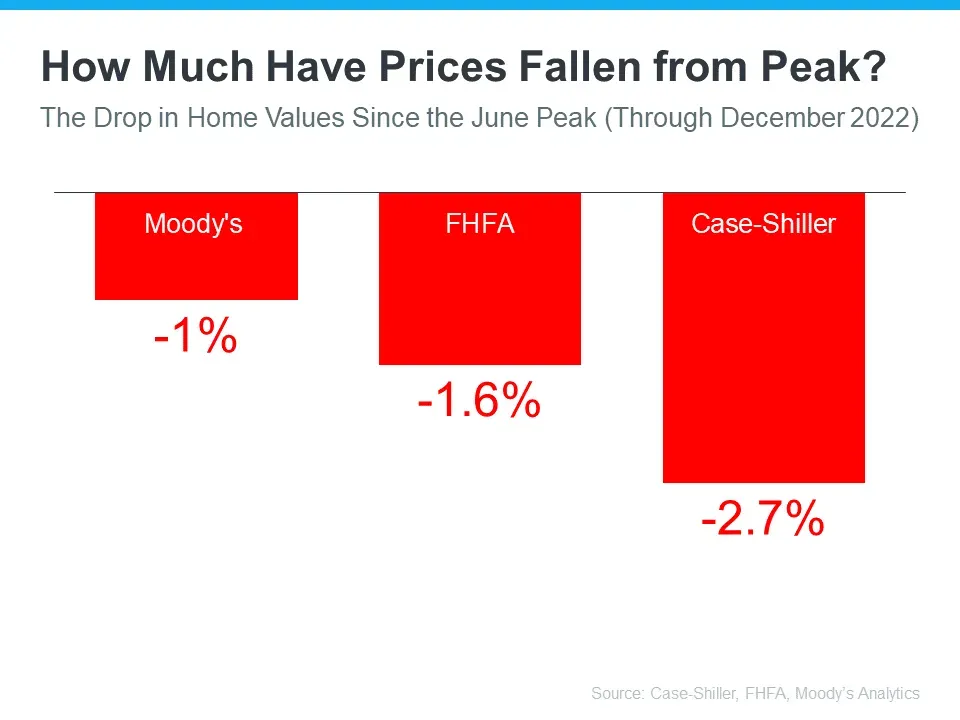

Right now it is not possible for prices to drop more. Let me tell you what the news isn’t telling you:

Did you know that according to the National Association of Realtors the average housing inventory for a healthy market is 1.5M homes on the market…?

Did you know that in order for prices to drop we have to have inventory north of 1.5M…?

And did you know that according to the Real Estate Experts, right now we are at an inventory of 600K which is only 300K more from last year???

Did you know that?

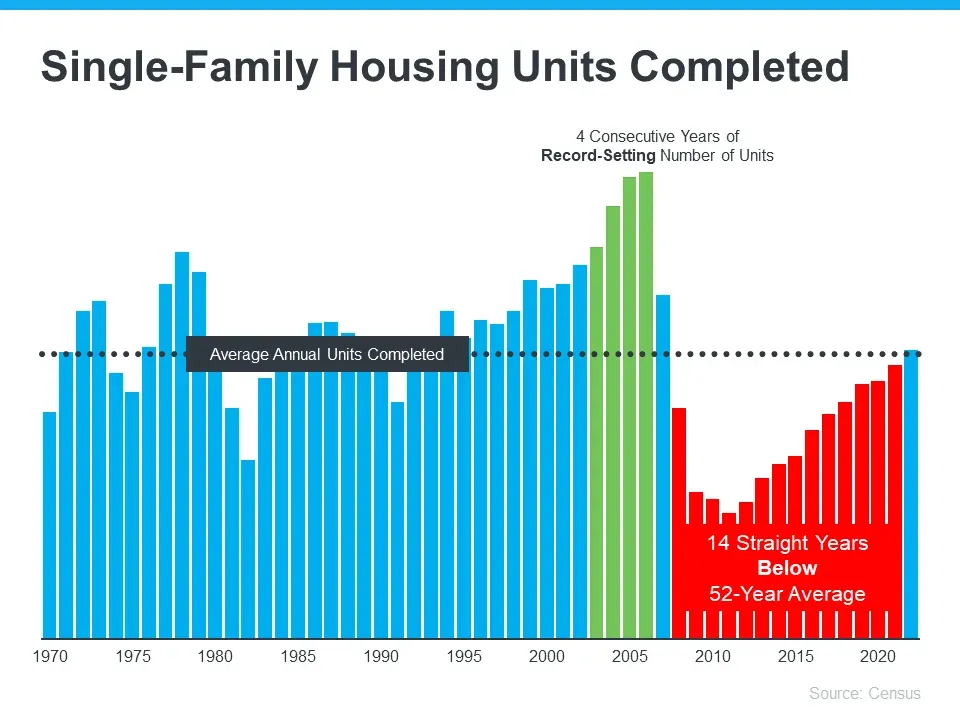

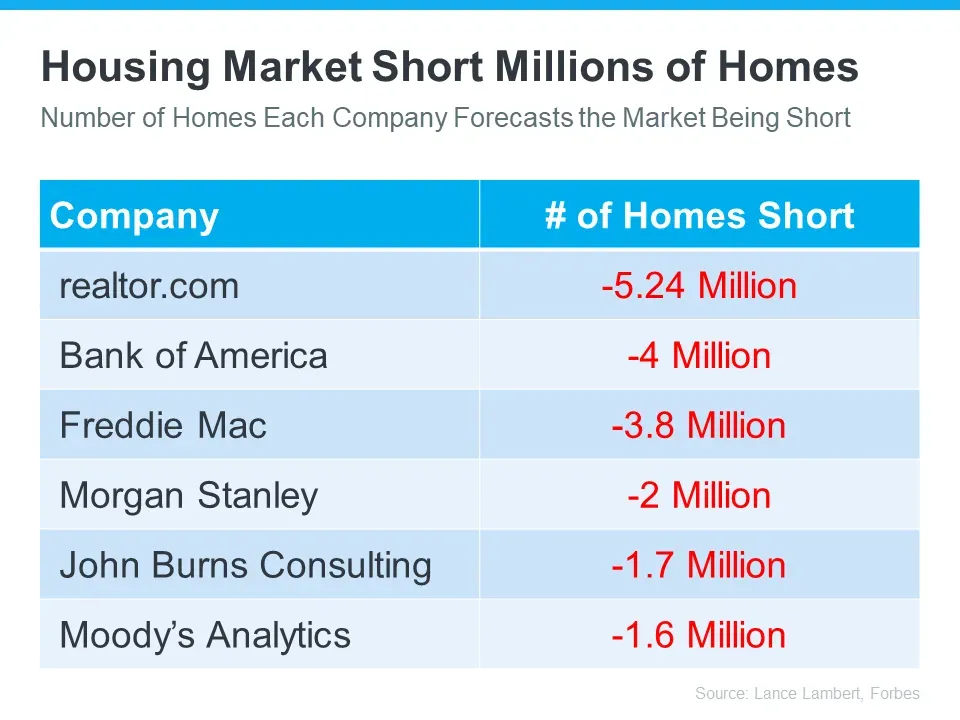

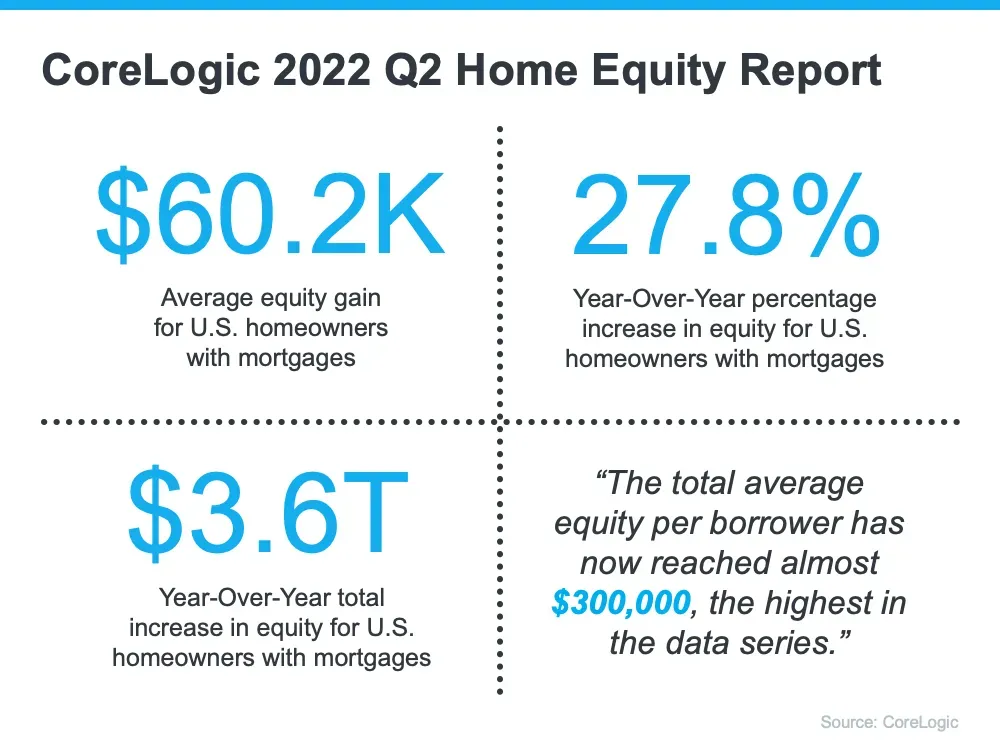

For 14 straight years, we have been below the 50-year average regarding homes being brought to the market. This led us to a deficit; We get a 2.75% interest rate and buyers rush in during COVID due to low rates without the inventory to support demand. This created the environment for prices to spike. All of the experts are pointing to the number of homes we are short when making their forecasts, telling us there aren’t enough homes for us to buy. This combined with homeowners having the highest equity available is a great motive to sell before the market absorbs free COVID equity as prices stabilize.

If selling your home is the plan we are more than happy to provide you with a free market evaluation to determine what your home would sell for. Also, we can give you tips on what to do and what not to do to sell your home for the most amount of money, and we can go over all the various closing costs you will incur so you will know exactly what you’ll have left in your pocket after all expenses. It’s FREE of charge and obligates you to nothing. If this sounds helpful give us a call at (714) 886-3627.

Should I Buy a Home Right Now?

A lot of people are asking themselves, should I buy a home right now?

The question we should be asking ourselves is: is it cheaper to rent or to own a home?

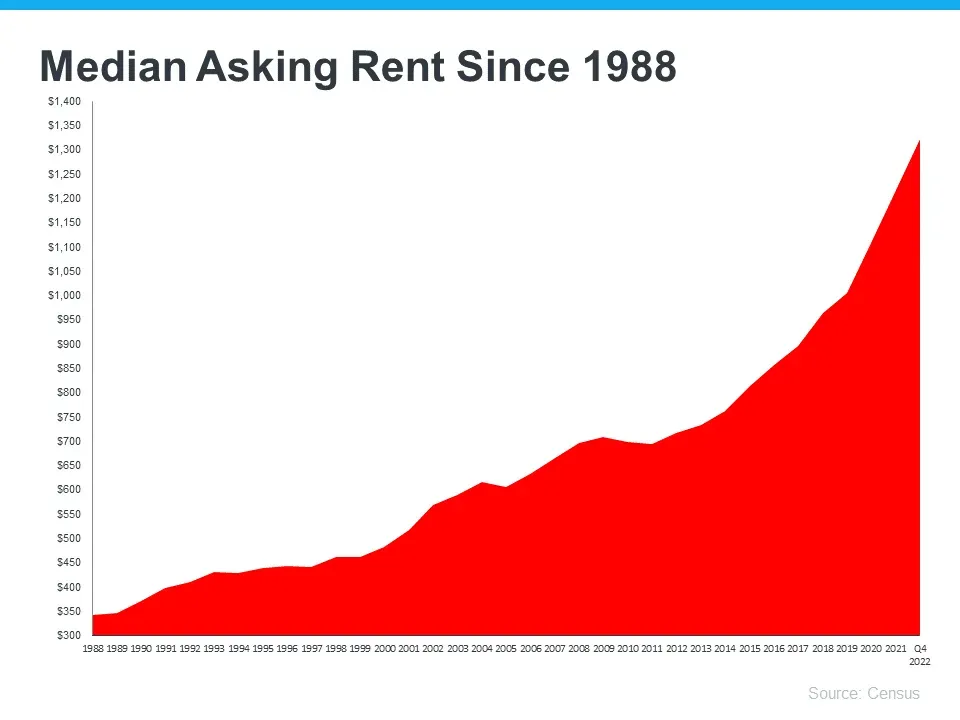

Rent always goes up. It has continuously gone up since 1988. Your landlord will always ensure that rent is at fair market rent, nobody likes a loss, and the economy supports an increase in rent due to rising overhead costs.

When you buy a home your monthly payment is consistent month after month. You have a fixed cost for the life of the loan which gives you stability in your finances and when budgeting year after year. Not only that but this too! Prices go up! America is known as a great place to buy real estate because of its track record over the long haul of prices going up, just like rent.

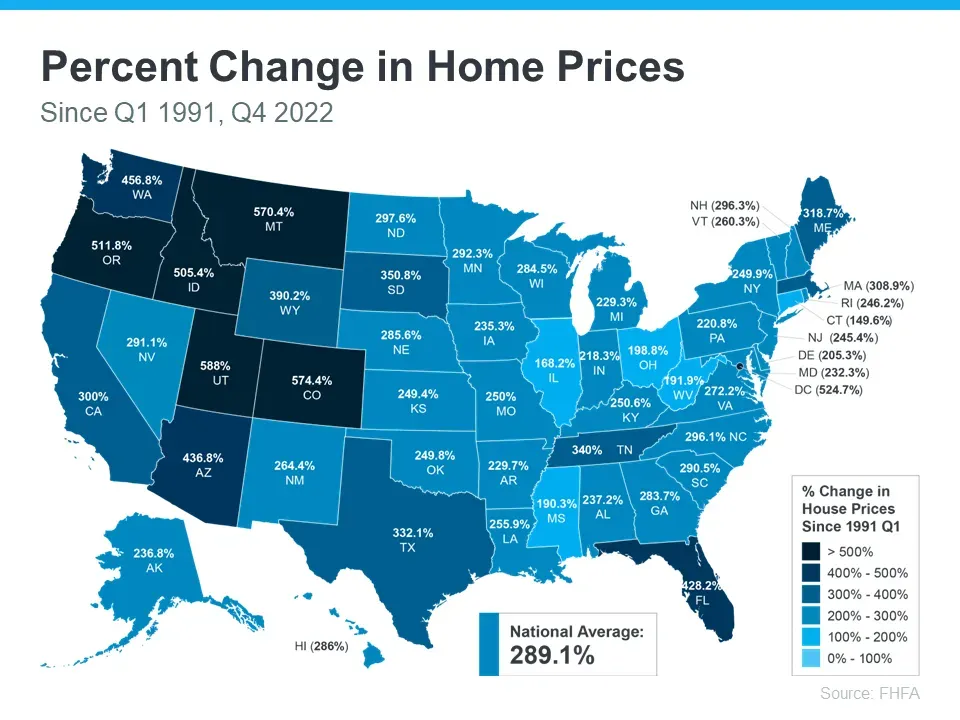

Over the last 30 years, the average appreciation in America is almost 300%. Rents always go up, prices go up. So the real question is:

Do you want to pay your landlords’ mortgage and give them equity, or wouldn’t you prefer to pay yourself and put that money back into your equity?

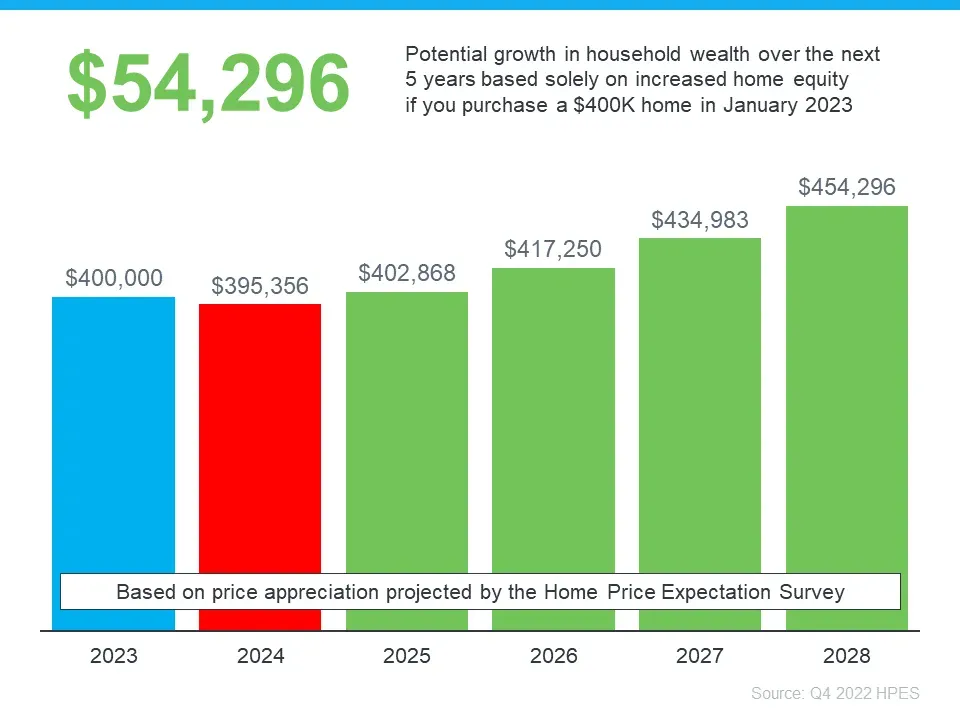

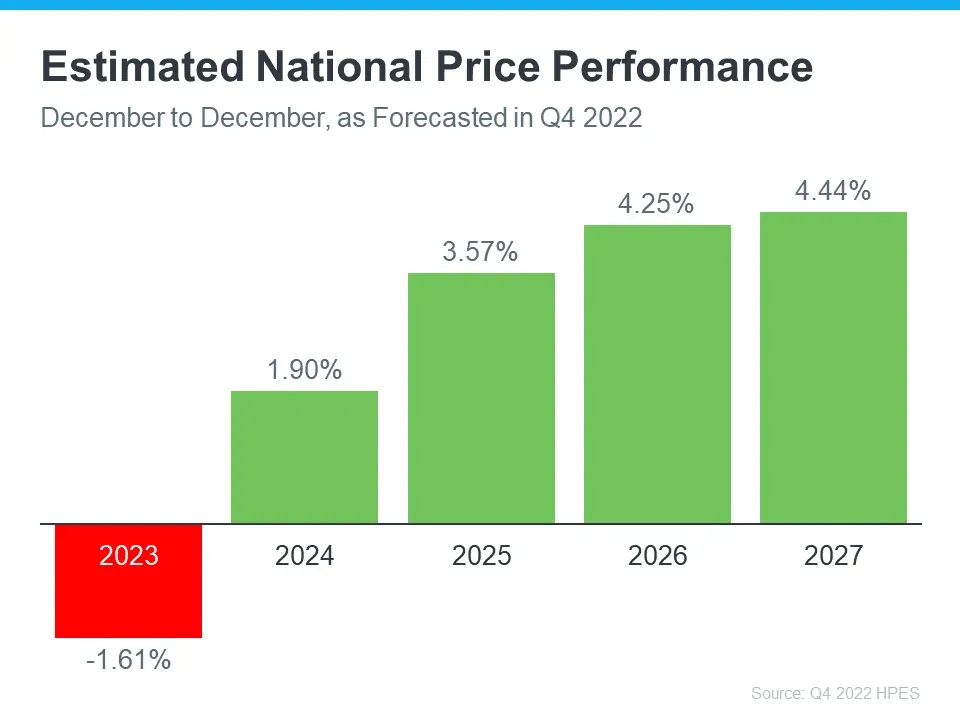

Let’s take a look at what that would look like on a $400K home bought in January 2023.

You would have roughly $54,296 of equity and not your landlord. Right now it’s a great time to get a good deal. Not only have prices been adjusting to a post-COVID market but rates also recently dropped as a result of the banks closing. The rates are jumping a lot between high and low. In this market, the move that savvy buyers make is called marrying the home and dating the rate. You buy a home at a good price, because when prices are good interest rates are not, and then you refinance later at a rate that works for you. You get ONE shot at getting a good deal with the continuous appreciation America has but you have multiple opportunities to get a good rate.

Our in-house lender has some rare programs available as previously mentioned:

- We can redirect your down payment funds towards buying down your rate and it still counts as a down payment.

- We can get you “yesterday's†low rates in today’s market.

- We have a unique opportunity to assist you in getting as close as you possibly can to a 4.5% rate with our partner lenders’ various exclusive programs, tools, and resources.

If you are considering buying your first home or upgrading your current home to your dream home or forever home we provide our clients with exclusive access to Off Market Properties such as Foreclosure, Pre-Foreclosure, For Sale By Owner, and our Exclusive RBID Homes and other Distressed Sales that you won’t find on Zillow, Trulia, or Realtor.com. It’s a free service and, of course, you’re never obligated to buy a home. To get exclusive access to these Off Market Properties that are not available online let’s get together here at our office and create a step-by-step plan of the best loan programs and you can select some Off Market homes to view. Call now at (714) 844-5696.

Here is some more data pointing to signs to buy now:

We’ve been hearing a lot of the same feedback that people are waiting for prices to drop AND rates to drop. Not only are you thinking that, but so is everyone else. And if you are waiting for that and you are not already in escrow about to close… you’re missing the opportunity you’ve been waiting for. Here is why:

- Prices and interest rates have an inverse relationship. When prices go up, rates drop. When prices drop, rates go up.

- Both prices and rates only drop together in the midst of an anomaly of a current event such as COVID-19 and Banks closing.

- By the time you hear it in the news, it’s already over and gone. Here’s why, we can only provide data verifying the lowest prices and lowest interest rates during a period of time after the fact. In other words, we only have collected verifiable data after the deals have closed and recorded, and we have new higher prices or rates to compare it to. The information comes in arrears, not in advance.

If you wait for prices and you wait for rates to be low to find a good deal, and everybody else who is waiting just like you hears about it in the news after the fact… guess what you have? Walmart on Black Friday and inventory are absorbed fast, multiple offers, above list price negotiations.

With all the data we have shared it is important to stick to the facts. Media sells, fear sells, and negativity sells. Always keep in mind what the whole story is. All too often we make decisions on content without the full context. We would like to close this edition of The Smith Report by wishing you all continued success in all your endeavors this 2023!

Don’t be easily swayed or fooled by the headlines of the news. Fake news headlines are made to sell news by people who don’t understand or work in the Real Estate Market. Remember that those are news stories, fake news, and that negativity sells not the heroic events of our Military, Law Enforcement, Paramedics, Firefighters, Doctors, and Nurses.

Seek the reality of the situation.

As always, we are not here to hustle you, we are not here to sell you… We are here to inform you, we are here to serve you, and we are here to help.

We are more than happy to provide you with exclusive access to Off Market Properties such as Foreclosure, Pre-Foreclosure, For Sale By Owner, and our Exclusive of RBID Homes and other Distressed Sales that you won’t find on Zillow, Trulia, or Realtor.com.

We are more than happy to provide you with a free market evaluation to determine what your home would sell for. Also, we can give you tips on what to do and what not to do to sell your home for the most amount of money, and we can go over all the various closing costs you will incur so you will know exactly what you’ll have left in your pocket after all expenses.

If you are looking to buy now or sell now, we are always available to provide the most accurate market evaluation and create the most detailed step-by-step plan for your successful home-buying journey.

Feel free to give us a call at (714) 844-5696.